Contents

Massive SMS “Toll Fee” Scam Sweeping the U.S.: FBI Issues Warning

By Thiruvenkatam, www.prowell-tech.com

Overview

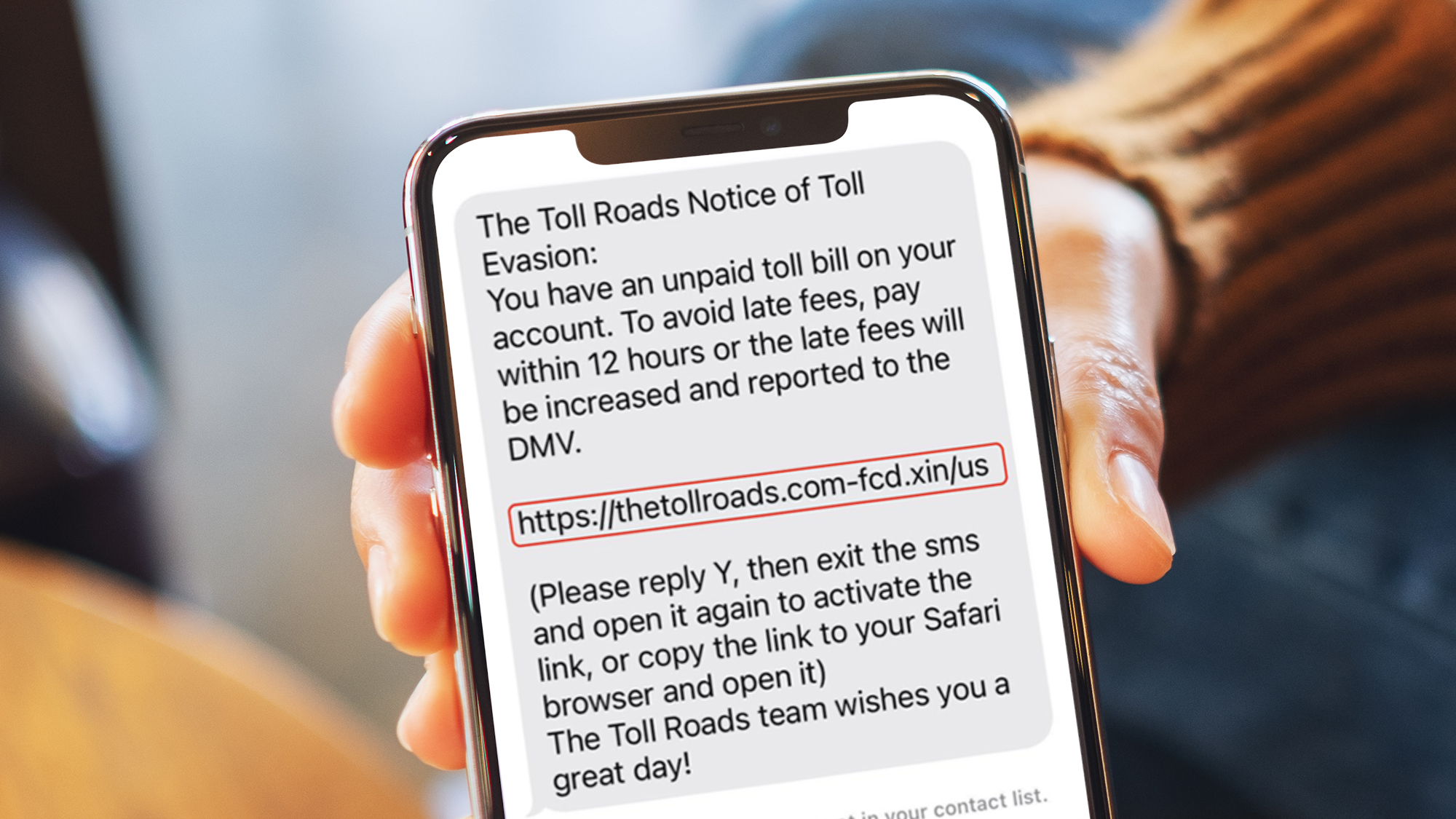

A dangerous new phishing scam—the “SMS toll fee” scam—is rapidly spreading throughout the United States. Cybercriminals send text messages disguised as notifications about outstanding tolls, parking tickets, or other minor fees. The messages attempt to steal personal information, payment details, or both.

The Federal Bureau of Investigation (FBI) has stepped in with a public service announcement, urging citizens to stay alert for suspicious text messages and to follow best practices to avoid falling victim to these fraudulent schemes. Below, we explain how the scam works, why it’s so effective, and the steps you can take to protect yourself.

How the Scam Works

-

Fake “Toll” Text Messages

Attackers send SMS messages claiming that you have unpaid tolls, traffic fines, or parking fees. To build credibility, these messages often include official-looking details—like a case number or partial license plate information. -

Malicious Links

The text typically contains a link to a website that mimics a legitimate payment portal. Once you click, you’re asked to enter sensitive data (credit card numbers, driver’s license information, or even Social Security numbers). -

Social Engineering Tactics

Criminals rely on urgency and the fear of additional fines or late fees. They may claim you must “respond immediately to avoid legal action,” prompting hurried decisions and reduced caution. -

Data Harvesting and Fraudulent Charges

The ultimate goal is to harvest personal information and payment credentials. The scammers may then make unauthorized purchases or even commit identity theft using stolen data.

Why It’s So Effective

- Sense of Urgency: People often pay tolls and small traffic fees right away to avoid escalating penalties. Scammers capitalize on that anxiety.

- Credible-Looking Messages: The texts can appear highly authentic, sometimes even displaying shortened URLs or official-sounding agency names.

- Widespread Phone Use: Almost everyone has a phone, and text messages are more immediate and personal than emails. That immediacy raises the likelihood that someone will fall for a fake notification.

The FBI’s Guidance and Best Practices

According to the FBI, awareness is the strongest defense. Here’s what you can do:

-

Avoid Clicking Suspicious Links

- Hover or Preview First: If your phone or messaging app has a link preview feature, inspect the URL carefully before tapping.

- Go Directly to Official Websites: Instead of clicking a link, open a browser and type in the toll agency’s verified URL yourself.

-

Verify Before Paying

- Check Your Recent Travel Records: Did you actually drive on a toll road recently? Use official toll websites or apps to see if you truly owe anything.

- Call the Agency: Look up the phone number on an official government or toll service website, then call directly to verify fees or fines.

-

Never Share Personal or Financial Details via SMS

- Credit Card Info: Reputable agencies typically provide secure, well-known payment portals. They won’t demand you text sensitive data.

- Identity Information: A legitimate toll service won’t ask for your Social Security number to process a fee.

-

Update and Secure Your Devices

- Install Security Software: Use trusted mobile security or antivirus apps.

- Enable Automatic Updates: Ensure your phone’s operating system and apps are up to date to patch vulnerabilities.

-

Report Suspicious Activity

- FBI Internet Crime Complaint Center (IC3): If you believe you’ve been scammed or received a malicious text, report it at ic3.gov (in the U.S.).

- Local Authorities: Some jurisdictions have hotlines or online portals to report spam or scam attempts.

Additional Steps to Protect Yourself

- Block and Filter: Most smartphones have options to block specific numbers. Using call- and text-filtering services can also help reduce unwanted messages.

- Consider Multi-Factor Authentication (MFA): Whenever a site or service offers MFA, enable it. That way, even if scammers steal your password or personal info, they’ll have a tougher time accessing your accounts.

- Stay Informed: Scam tactics evolve quickly. Keep up to date on the latest warnings from organizations like the FBI, FTC (Federal Trade Commission), and your local consumer protection agencies.

What to Do if You’ve Fallen Victim

-

Immediately Contact Your Bank

- Cancel or freeze any compromised payment cards.

- Monitor your account for suspicious transactions.

-

File Reports

- FBI IC3: Submit a report to the Internet Crime Complaint Center at ic3.gov.

- FTC: You can also file a complaint with the Federal Trade Commission via reportfraud.ftc.gov.

-

Change Relevant Passwords

- If you entered login details into the scam site, change those credentials everywhere you use them (and do not reuse old passwords).

-

Review Your Credit Report

- U.S. residents are entitled to free annual credit reports from the major bureaus. Watch for new lines of credit or unfamiliar inquiries.

Looking Ahead

As texting becomes a more central part of daily life, scams that rely on SMS will likely continue to proliferate. Cybercriminals constantly refine their methods, testing new angles of attack. The best defense is staying informed, exercising caution, and double-checking any request for money or personal information through a text message.

By staying vigilant, you can protect yourself and help spread the word to friends, family, and colleagues who may be less aware of the latest scam tactics. Ensuring everyone knows how to spot a fraudulent message is the quickest way to derail these widespread SMS cons.

Key Takeaways:

- Stay Skeptical: Treat any unexpected toll or fee text message with caution.

- Verify: Use official websites, confirmed phone numbers, or legitimate apps to check outstanding balances.

- Report: Alert the authorities (FBI, FTC, local consumer agencies) if you suspect malicious activity.

- Protect: Keep devices updated, use blocking and filtering tools, and never share personal info via SMS.

Disclaimer: This article is a summarized rewrite for educational purposes and does not contain the exact text of the original TechRadar article. Please refer to the official sources and the original publisher for the full context and details.

Written by Thiruvenkatam, for www.prowell-tech.com.