By Data Scientist & Analytics Consultant | 10+ Years Experience

Ten years ago, I sat in a boardroom trying to explain to a CEO why his “gut feeling” about sales trends was going to cost the company millions. He pointed to a graph going up; I pointed to a dataset that said the underlying customer base was eroding.

I wasn’t using a crystal ball. I was using predictive analytics. Six months later, the sales dropped exactly as the model predicted, and I finally got the budget to build out a proper data team.

If you are reading this, you’ve probably heard the buzzwords. But after a decade of cleaning messy data and tuning algorithms, I can tell you that predictive analytics isn’t magic. It is simply the math of probability applied to history.

Here is my no-nonsense breakdown of what it actually is, how I use it daily, and real-world examples that go beyond the theory.

📋 Quick Summary: The 30-Second Answer

If you are skimming this on your phone, here is what you need to know:

- What it is: Using historical data + statistical algorithms to calculate the probability of a future outcome. It never gives you a “Yes/No,” only a “% likelihood.”

- The Golden Rule: “Garbage In, Garbage Out.” I spend 80% of my time cleaning data and only 20% actually predicting things. If your data is bad, your predictions will be dangerous.

- Top Use Case: Predicting when a customer is about to leave (Churn) so you can offer them a discount before they click cancel.

- Barrier to Entry: You don’t need a PhD anymore. In late 2025, tools like automated ML (AutoML) platforms handle the heavy math, but you still need to understand the logic.

The Core Concept: It’s Not a Crystal Ball, It’s a Weather Forecast

When I train junior analysts, I always start with this distinction.

Descriptive Analytics tells you what happened. (e.g., “We sold 500 units last month.”)

Predictive Analytics tells you what might happen based on patterns. (e.g., “We have an 82% chance of selling between 480 and 520 units next month.”)

Notice the nuance? It’s about probabilities.

In my workflow, I treat predictive models exactly like a weather forecast. If the model says there is a 90% chance of rain, I bring an umbrella. If my churn model says a customer has a 90% risk of leaving, I send a coupon.

How It Actually Works (The “Under the Hood” View)

I don’t want to bore you with the calculus, but here is the actual workflow I use when a client asks me to “predict the future.”

- Data Collection (The Messy Part): We pull years of history.

- Preprocessing: This is where the real work happens. I have to fix missing values, remove duplicates, and standardize formats.

- [SCREENSHOT TIP: Take a screenshot of a messy Excel sheet with “Null” values highlighted to show what bad data looks like.]

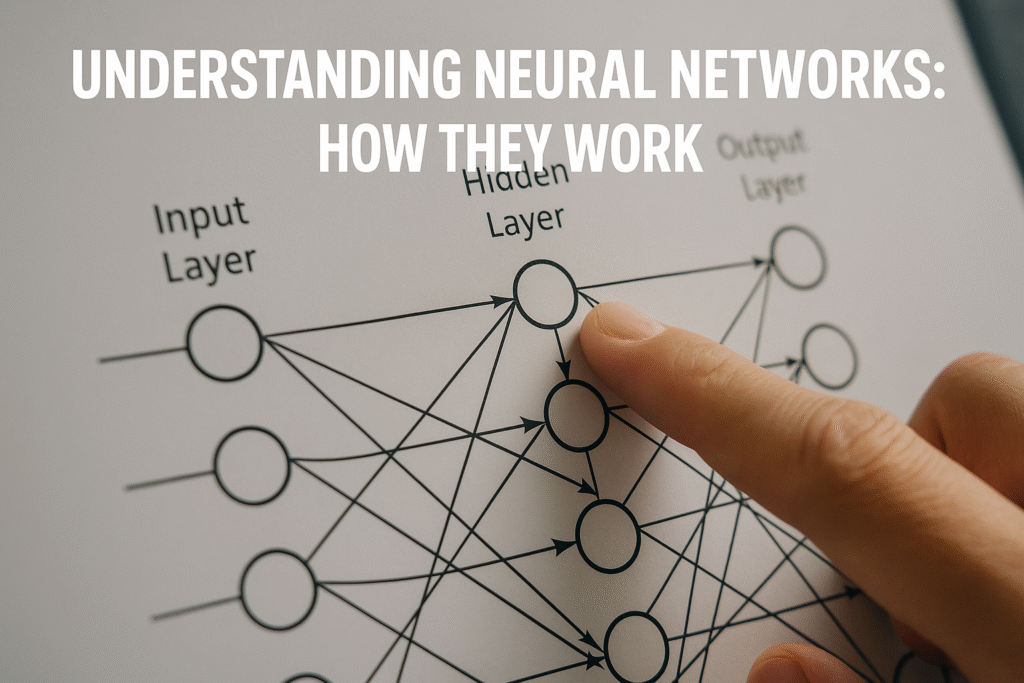

- Model Training: I feed the clean data into an algorithm (like a Regression model or a Decision Tree). The computer “learns” the patterns.

- Testing: I hide the last 3 months of data from the computer and ask it to predict them. If the prediction matches what actually happened, the model is ready.

3 Real-World Examples (From My Projects)

Theory is fine, but let’s talk about where the rubber meets the road. These are three specific scenarios where I’ve deployed these models.

1. The “Save-a-Customer” Algo (Churn Prediction)

This is the “Hello World” of predictive analytics. I once worked with a subscription box service that was bleeding users. They were sending generic “We miss you” emails to everyone who cancelled. It was too little, too late.

What we built: We analyzed behavior before the cancellation. We found that users who stopped logging in for 7 days and visited the “Billing Settings” page were 85% likely to cancel within 48 hours.

The Result: We set up an automated trigger. If a user hit that specific behavior pattern, the system sent a “50% off your next month” email immediately. Retention went up 12% in the first quarter.

2. Predictive Maintenance (The “I’m About to Break” Alert)

I worked with a logistics company that managed a fleet of delivery trucks. Breakdowns were costing them a fortune in tow trucks and late fees.

What we built: We installed sensors that monitored engine temperature and vibration. We didn’t wait for the engine to smoke. We trained a model to recognize the subtle vibration pattern that happens two weeks before a transmission failure.

The Reality Check: It wasn’t perfect. At first, we had too many “False Positives” (predicting a breakdown when the truck was fine). Mechanics got annoyed. We had to retune the sensitivity. This is a common pain point—balancing sensitivity vs. specificity.

[IMAGE TIP: Take a photo of a check engine light or a car dashboard to visualize the concept of ‘maintenance alerts’.]

3. Retail Inventory (Avoiding the “Out of Stock” Nightmare)

Nothing kills a business faster than having customers with money but no product to sell them.

What we built: For a mid-sized retailer, we moved them off simple Excel averages. A simple average says, “We sold 100 coats last December, so order 100 this year.”

A predictive model looks at:

- Local weather forecasts (Is it colder than last year?)

- Economic inflation rates.

- Current Google Search trends for “winter coats.”

By adding those external factors (called “features” in my industry), we predicted a 20% spike in demand despite the previous year being slow. We were right, and they were the only local shop with stock left by Christmas Eve.

The Toolkit: What You Need to Get Started

You don’t need a supercomputer. Here is my current stack as of late 2025:

For The Beginner (Low Code)

- Microsoft Excel: Yes, really. You can do linear regression in Excel. It’s where I start most prototypes to see if the data has any signal.

- Tableau / PowerBI: Great for visualizing the trends. The built-in forecasting tools have gotten surprisingly good recently.

For The Pro (Code Heavy)

- Python: This is the industry standard. Libraries like

scikit-learnandpandasare what 90% of us use. - R: Better for pure statistics, but Python is better for putting things into production.

[SCREENSHOT TIP: Screenshot of a simple Python code snippet in a Jupyter Notebook showing a .predict() function call.]

Who This Is NOT For (The Red Flags)

I turn down about 30% of the clients who come to me wanting “AI” or “Predictive Analytics.” Why? Because they aren’t ready.

1. You don’t have historical data. I can’t predict next month’s sales if you didn’t track last year’s sales. If you are a brand new startup with zero history, you need market research, not predictive analytics.

2. You want 100% certainty. If a boss demands to know exactly what the stock price will be tomorrow, I walk away. Predictive models manage risk; they do not eliminate it.

3. Your data is siloed. If your sales data is in Salesforce, your marketing data is in HubSpot, and your inventory is on a clipboard in the warehouse, we can’t build a model. We need to centralize that data first (Data Engineering) before we can analyze it.

Common Mistakes I See Beginners Make

After reviewing hundreds of projects, here are the traps to avoid:

- Overfitting: This is when you train your model so hard on historical data that it memorizes the past but fails at predicting the future. It’s like a student who memorizes the answers to the practice test but fails the real exam because the questions were slightly different.

- Confusing Correlation with Causation: Just because ice cream sales and shark attacks both go up in July doesn’t mean ice cream attracts sharks. (They both go up because it’s hot). If you feed this into a model, you might make a very silly business decision to ban ice cream to save swimmers.

- Ignoring the “Human in the Loop”: Never let a model auto-execute high-stakes decisions without human review. I once saw a fraud detection model flag a CEO’s credit card as “stolen” while he was trying to pay for a company dinner. Embarrassing.

My Final Verdict

Predictive analytics is the difference between driving with your eyes open vs. driving blindfolded.

It requires an investment—mostly in cleaning your data and shifting your mindset from “gut feeling” to “probability.” But in my experience, once you start making decisions based on data-driven forecasts, you never go back.

Start small. Don’t try to predict the global economy. Try to predict something simple, like your weekly website traffic or monthly expenses, using a basic spreadsheet.

Have you tried using predictive tools in your business? Let me know in the comments if you hit the same “bad data” wall that I did when I started.

Disclaimer: I am a data analytics professional, not a financial advisor. The examples above are for educational purposes regarding the technology of analytics. Always consult with a qualified professional before making significant financial investments based on predictive models.

Discover more from Prowell Tech

Subscribe to get the latest posts sent to your email.